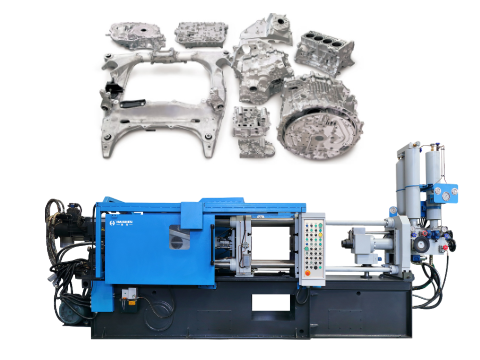

Mexico’s aluminum die-casting industry is an important industry closely related to its booming automobile manufacturing industry. It has significant growth potential, but also faces challenges in technology dependence and innovation.So there are many Aluminum die casting companies in Mexico.

According to Haichen’s market research, there are more than 100 die casting plants in Mexico. The top aluminum die casting manufacturers include Bocar Group, Nemak, Ryobi, Dynacast and Pace Industries, most of which have sales of $400 million. These companies focus on high-volume applications and are competitive in these areas, mainly in the automotive and appliance industries.

Are you looking for an aluminum die casting machine, mold, equipment company to produce your products in Mexico? Then you have come to the right place. We have analyzed hundreds of local Mexican aluminum die casting machine, mold, equipment companies and listed some of the top companies for your reference and further research:

Haichen showing expanded and detailed overview of the top 10 aluminum die-casting companies in Mexico, including their technical capabilities, strategic initiatives, and market impact:

1. Nemak

- Headquarters: Monterrey, Mexico

- Founded: 1979

- Key Strengths:

- Global leader in automotive aluminum components, specializing in high-pressure die casting (HPDC) for engine blocks, transmission housings, and EV battery trays.

- Pioneered “Mega-Cast” technology for single-piece structural components (e.g., EV chassis).

- Clients include GM, Ford, BMW, and Tesla (supplying battery enclosures for Cybertruck).

- Recent Projects:

- 2023 partnership with Volkswagen to develop 800V EV platform aluminum battery trays.

- AI-powered quality control systems deployed in Monterrey plant.

- Market Share: Holds ~12% of global automotive aluminum die-casting market; 35% of its global capacity is based in Mexico.

2. Bocar Group

- Headquarters: San Luis Potosí, Mexico

- Founded: 1958

- Key Strengths:

- Strategic alliance with GF Casting Solutions (Switzerland) for lightweight EV and energy sector components.

- Hybrid Casting™ technology: Combines die casting with additive manufacturing for complex geometries (e.g., hydrogen fuel cell parts).

- Fully automated die-casting cells using Bühler machines.

- Major Clients: Daimler, Bosch, Siemens Energy.

- Expansion: 2022 R&D center in Querétaro focused on hydrogen storage solutions; produces 60% of its global output in Mexico.

3. Ryobi Die Casting

- Parent Company: Ryobi Limited (Japan)

- Mexico Facility: Guanajuato (expanded in 2024 to 80,000 m²)

- Key Strengths:

- High-speed die casting (injection speeds up to 10 m/s) for 5G infrastructure and automotive electronics.

- Supplies ECU housings and heat sinks for Tesla’s Gigafactory Mexico.

- Investment: $50 million expansion to align with nearshoring trends; 40% capacity boost by 2024.

4. Dynacast International

- Global HQ: Charlotte, NC, USA

- Mexico Facility: Nuevo León

- Specialization:

- Micro-die-casting for medical devices (e.g., endoscope components) and consumer electronics (e.g., Apple Watch clasps).

- ISO 13485 and IATF 16949 certified.

- Innovation: 2023 launch of magnesium alloy die-casting line for lightweight aerospace applications.

5. Grupo Industrial Saltillo (GISSA)

- Stock Exchange: BMV: GISSA

- Subsidiaries:

- Docol: Aluminum brake calipers (15% share in North American aftermarket).

- Fundimax: EV motor housings for Rivian and Lucid.

- Breakthrough: Patented a heat-treatment-free aluminum alloy in 2023, reducing post-casting costs by 18%.

6. Pace Industries

- Parent Company: Atlas Holdings (USA)

- Mexico Plant: Chihuahua

- Core Products:

- Automotive engine mounts (8 million units/year) and HVAC compressor housings (25% of North American market).

- Sustainability: 2024 circular economy initiative recycles 95% of scrap aluminum.

7. GF Casting Solutions (via Bocar Partnership)

- Technology:

- Flow-Fill® simulation software optimizes mold design, achieving 99.3% defect-free parts.

- Supplies rear axle housings for Porsche Taycan using squeeze casting for enhanced strength.

- R&D: 8 patents filed in 2023 for lightweight EV structural components.

8. BM Castings

- Location: Chihuahua

- Technology:

- Italian IDRA 6,000-ton die-casting machines + German GOM 3D scanning for precision inspection.

- Key supplier for ZF’s steering systems and solar inverter cooling modules.

- Awards: 2024 “Best Manufacturer in Chihuahua” for sustainability and innovation.

9. POWER-CAST Monterrey

- Parent Company: KOPF Group (Germany)

- Product Range:

- Aluminum die-cast automotive seatbelt buckles (20% global OEM share).

- Zinc die-cast luxury door hardware for Assa Abloy.

- Hybrid Solutions: Integrates die casting with plastic injection for multi-material components (e.g., LED light housings).

10. Martinrea Honsel

- Parent Company: Martinrea International (Canada, TSX: MRE)

- Specialization:

- Semi-Solid Metal (SSM) casting for lightweight crash-resistant components (e.g., A-pillars).

- Exclusive supplier for GM’s Ultium platform under a 10-year contract (2023).

Industry Insights:

- Cost Advantages: Labor costs 1/3 of U.S. levels; electricity prices 15% lower than China.

- Clusters: 70% of Mexico’s die-casting capacity is concentrated in the Chihuahua-Nuevo León-Coahuila triangle.

- Challenges: Reliance on imported machinery (e.g., Idra, Bühler); limited local mold design expertise.

- Policy: 2024 government subsidies for >5,000-ton die-casting machines to boost EV part production.

This expanded profile highlights each company’s unique value proposition, positioning Mexico as a critical hub for advanced aluminum die casting in North America.

Solution

The sourcing database provides buyers with instant information on foundries in Mexico without the time and expense of having sourcing professionals travel to the site in person. Buyers can search and evaluate suppliers with open capacity for aluminum alloy die castings ranging from 30 tons to 2000 tons.

And contact us directly on our Haichen website for more details on our machinery products.