Cast Ladle Cup manufacturers in China:

- Weihai Gongyou Foundry Machinery Co., Ltd.

- Qingdao Casting Machinery Group Co., Ltd.

- Huizhou Henglida

- Foshan Nanhai Shuoyi Machinery

- Dongguan Xinhua Mould Parts Co., Ltd

- Haichen Machinery

- Dongguan Yaneng Machinery Technology Co., Ltd

- Italpresse Die Casting Equipment (Shanghai) Co., Ltd

- Qingdao TTWY Manufacturing Co., Ltd.

- Xinxiang Great Wall Steel Casting (Henan)

Ladles are typically used in industrial fields such as metallurgy, casting, and glass manufacturing, especially in production processes that require high-temperature melting of metals or materials.

Chinese foundry ladle manufacturers, represented by Qingdao Kaijie Heavy Industry, Fujian Geli Machinery and Qingdao Baiter Machinery, provide high-temperature resistant and customized ladle products.

Meanwhile, enterprises such as Qingdao Foundry Machinery Group possess comprehensive strength in the field of foundry equipment.

Cast Ladle Cup

Also known as die-casting spoon is the core tool used to hold high-temperature metal solutions.

Such as molten aluminum, molten copper, zinc alloy solution) in the die-casting process.

Which needs to have the characteristics of high temperature resistance, corrosion resistance, thermal shock resistance, etc.

Its application scenarios include automatic soup manipulator matching, manual pouring, oxide scale barrier, etc.

Which directly affect the quality and production efficiency of die castings.

Weihai Gongyou Foundry Machinery Co., Ltd.

The core business is the design and manufacture of ladles for casting, covering a full range of products such as spheroidizing ladles, electric iron ladles, and steel ladles.

It is a large-scale Ladle production base in China.

The extended product line includes casting supporting machinery such as baking machines, electric furnace feeding baskets, and dust removal equipment.

Qingdao Casting Machinery Group Co., Ltd.

Main business includes casting production lines and supporting equipment, covering the entire process of sand treatment, molding, cleaning and other equipment.

Although Ladle products were not directly mentioned, as a comprehensive casting equipment supplier, its business may cover ladle-related equipment (such as transfer and cleaning systems).

Huizhou Henglida die-casting machine accessories

Product features: special cast iron casting, high temperature resistance (can withstand the temperature of aluminum alloy liquid), wear resistance.

And unique heat treatment process, specifications covering 0.3KG to 20KG, support cold chamber die-casting machine matching.

It is recommended to apply a covering agent for a longer life.

Competitiveness:significant price advantage, perfect after-sales service, registered capital of 30,000 yuan, established earlier (2014), stable supply chain.

Foshan Nanhai Shuoyi Machinery

Product features: Provide special cast iron casting manipulator spoon (0.3KG-20KG), corrosion resistance is better than ductile iron, spot supply, supporting release agent, coating agent and other consumables.

Competitiveness: Relying on the industrial cluster of the Pearl River Delta, the supply chain responds quickly, and the professional technician team provides technical support.

Dongguan Xinhua Mould Parts Co., Ltd

Product features: a leading enterprise in the mold accessories industry, with advanced surface treatment technology of mold pull rod (anti-wear and corrosion-resistant).

And the products occupy 35% of the mold market in Guangdong.

Competitiveness: Profound technology accumulation (10 years of production experience).

Suitable for high-temperature working environments, and the product line extends to die-casting consumables.

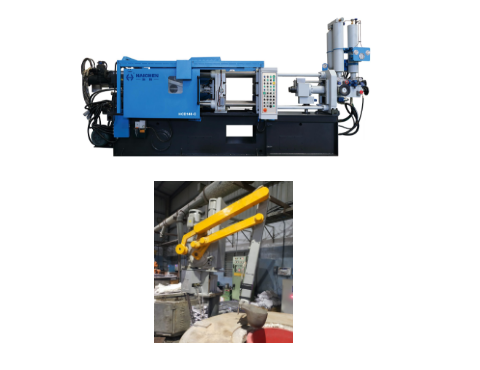

Haichen Machinery

High-end and customized needs: Haichen focuses on the manufacture of cold chamber die casting machines.

And hot chamber die casting machines, die casting molds, auxiliary machines, conventional pouring ladles and special pouring ladles.

Such as spheroidized casting ladles , serving steel, auto parts and other industries with high requirements for smelting process.

Cost-effective advantage: Haichen provides cost-effective products at reasonable prices, taking into account the needs of economy and environmental protection.

Dongguan Yaneng Machinery Technology Co., Ltd

Product features: production of zinc alloy pots, manipulator spoons, etc., with an annual turnover of 1.01 million to 20 million.

A plant area of more than 1,000 square meters, supporting well-known die-casting machine brands such as LK.

Competitiveness: Outstanding large-scale production capacity, multi-field applications (automotive, electronics, communications).

Italpresse Die Casting Equipment (Shanghai) Co., Ltd

Product features: Acting as an agent for ceramic spoons made in Sweden, using non-stick aluminum ceramic materials (melting point 1860 °C± 10 °C).

Closed small opening design, life of 6-12 months, no need for coating, thermal insulation performance is 15 times better than cast iron.

Competitiveness: high-end technology, maintenance-free and environmentally friendly, but the price is higher, facing the high-end market.

Qingdao TTWY Manufacturing Co., Ltd.

Introduction: Focus on the manufacture of casting equipment, especially pouring ladles.

Such as teapot type pouring ladles, thermal insulation pouring ladles, spheroidized pouring ladles.

Advantages: Gain the trust of customers at home and abroad with high quality, reasonable price and high-quality service.

And the products cover molten metal pouring, transfer and treatment (spheroidization) and other scenarios.

Xinxiang Great Wall Steel Casting (Henan)

Established: 1987

Capacity: 60,000+ tons/year

Flagship Product: 120T Heavy-Duty Ladles

Vacuum-refined ZG230-450 steel

Impact resistance: ≥50 J at -20°C

Customizable trunnion mounts for crane integration

Clients: Siemens, Thyssenkrupp, China Three Gorges Dam Project.

Technology Development Trend

Material Innovation: Research and development of high-entropy alloy coatings to improve corrosion resistance.

Explore carbon fiber composites to reduce the weight of the scoop.

Intelligent upgrade: Integrated sensors monitor the temperature and flow rate of molten metal in real time, adapting to Industry 4.0 die-casting production lines.

Process optimization: Combined with semi-solid die casting technology, reduce metal oxidation and prolong the service life of the spoon.

The market size and growth trend of ladle manufacturers in China

- The overall scale of the industry

- Growth drivers

- Technology upgrading

- Regional distribution

The overall scale of the industry

In 2023, the output of China’s die castings will reach 5.31 million tons.

With a market size of about 249.35 billion yuan, of which aluminum alloy die castings account for more than 80%.

As a key consumable, the market size of die-casting spoon is positively related to the die-casting industry.

Growth drivers

Demand for new energy vehicles:

The lightweight trend is driving a surge in demand for aluminum alloy die castings, driving the market for supporting consumables such as spoons.

It is estimated that the compound growth rate (CAGR) of the die-casting industry will reach 6% from 2024 to 2030, and the market size may exceed 8 trillion yuan in 2030.

Technology upgrading

The popularization of technologies such as high vacuum die-casting and integrated molding has put forward higher requirements for the accuracy and durability of the spoon and promoted product iteration.

Regional distribution

East China accounts for 35.6% of the die-casting market, followed by South China and Central China, with a significant industrial cluster effect.

Cast Ladle Cup Production Policy and Regulatory Impact

- Environmental protection policy

- Industrial upgrading orientation

- Access standards

Environmental protection policy

The Air Pollution Prevention and Control Law and the Water Pollution Prevention and Control Law mandate die-casting enterprises.

To reduce emissions and promote the transformation of spoon production to low-polluting materials (such as environmentally friendly coated cast iron).

Industrial upgrading orientation

“Made in China 2025” encourages the die-casting industry to be intelligent, and the demand for automated manipulators supporting the spoon increases.

Forcing suppliers to improve product accuracy and compatibility.

Access standards

The Ministry of Industry and Information Technology’s “Foundry Industry Access Conditions” puts forward clear requirements for energy consumption, process and product quality, eliminates backward production capacity, and accelerates industry integration.